Demand for loitering munitions is growing exponentially. Industry is challenged to scale up production capacity to adjust to the changing operational realities.

Loitering munitions (LMs) combine the capabilities of a small drone and a guided missile. They are designed to remain over a target area for short-to-extended periods, identify and verify targets using onboard sensors, then transition to attack mode, executing precision strikes by impacting the target.

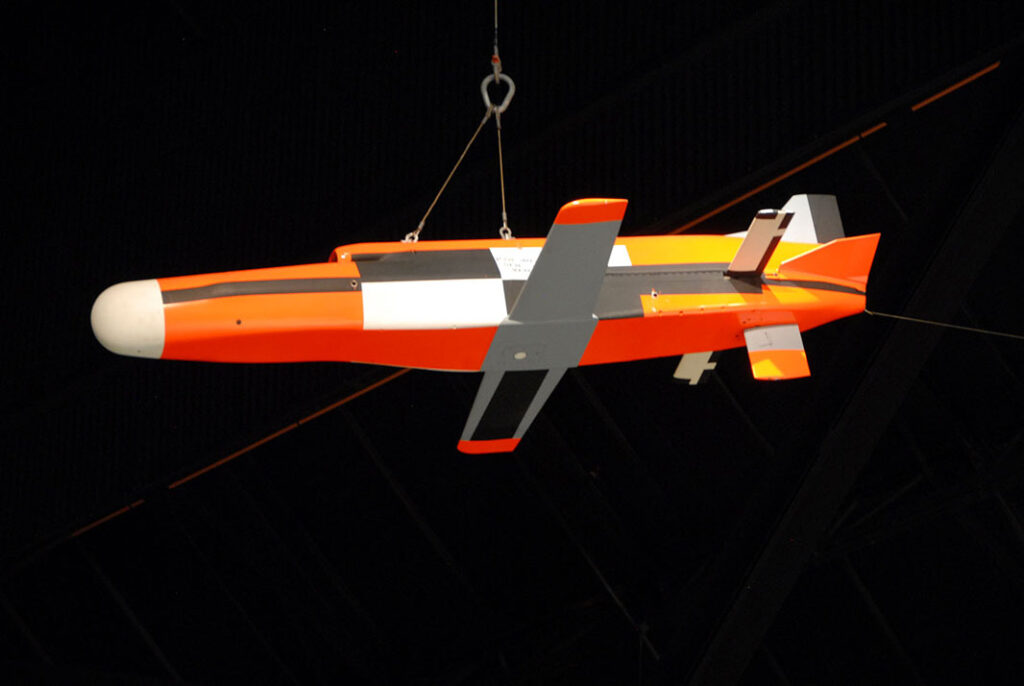

The concept can be traced to the 1980s, originally in the form of loitering missiles. Early models include the air-launched AGM-136 Tacit Rainbow loitering anti-radiation missile, developed by Northrop (now Northrop Grumman) along with Texas Instruments and Boeing, but cancelled by the US Department of Defense (DoD) in 1991 before it could enter production. The IAI Harpy, developed by Israel Aerospace Industries (IAI) and thought to have been first deployed in 1991, is generally considered the first operational drone-based LM. These early LMs were configured for the Suppression of Enemy Air Defences (SEAD) role. Since then, the mission profile has broadened significantly, and now prominently includes (among others) anti-personnel, anti-vehicle and anti-armour attacks.

LMs fill a capabilities niche between artillery and missiles, providing additional options and, depending on operational scenarios, potential advantages over other munitions. The most obvious advantage is the extended dwell time over the target zone, increasing the search window for hidden targets, permitting attacks against targets of opportunity, and the ability to analyse and prioritise targets before attacking. Unlike tube or traditional rocket artillery, LMs’ sensors allow them to discriminate between and verify individual targets, increasing precision and reducing the risk of collateral damage. Furthermore, given the two-way data link between UAV and operator, these sensors also provide the LM a secondary or alternate capability as reconnaissance and surveillance aircraft, and can provide immediate feedback about mission success. Also unlike shells and rockets, LM operators can divert the munition to different targets or fully abort the mission. Unlike either artillery or missiles, many LM classes can be recalled, recovered and reused if no target is found. Finally, LMs can be deployed by tactical vehicles and dismounted infantry, providing small units with beyond-line-of-sight (BLOS) precision-attack capability without the need to call in and wait for artillery strikes. Aside from these tactical considerations, LMs are often lower cost than missiles; as one example, the US Congressional Research Service in 2023 cited a unit cost of USD 6,000 for the Switchblade 300 tube-launched LM.

Proving grounds

LMs have been used increasingly in recent conflicts, including the 2020 Second Nagorno-Karabakh War (during which Azerbaijan launched numerous IAI Harpy and other LMs to significantly degrade Armenian air defences and armour) and the Syrian Civil War of 2016–2021 (during which the US supplied the Syrian Democratic Forces with circa 150 Switchblade series LMs).

The battlefield role of LMs jumped exponentially after the Russia’s full-scale invasion of Ukraine in 2022. Precise numbers of LMs deployed in the Ukraine war are difficult to verify, but there are estimates by reliable sources. Russian materiel loss tracking website lostarmour.info stated a figure of over 3,500 confirmed Lancet strikes as of early August 2025. Ukraine also quickly adopted LMs, using both western-supplied and domestically developed systems. Here, too, precise figures are largely classified. In October 2023, the vice president of US-based AeroVironment Inc. confirmed that his company had delivered “a very large number” of Switchblade 300 LMs to Ukraine, and was transitioning deliveries to the more powerful Switchblade 600. In 2024, AeroVironment went a step further, partnering with a Ukrainian firm for local manufacture of the Switchblade 600. In December 2024, Forbes magazine revealed that Florida-based Aevex Aerospace had delivered 5,000 Phoenix Ghost LMs to Ukraine up to that point, at a production tempo that peaked at roughly 230 units per month. The firm itself describes the Phoenix Ghost family as the “Nr. 1 US Government provided loitering munition to support the conflict in Ukraine.” Poland’s WB Group, which had a pre-war contract to sell 1,000 Warmate LMs to Ukraine, supported Kyiv’s war effort with an undisclosed number of systems. Ukraine’s domestic efforts included developing their own LMs. In summer 2024, Ukraine’s Digital Transformation Ministry confirmed that multiple companies were mass-producing such ‘Lancet analogues’.

Beyond traditional LMs, both sides in the Russo-Ukrainian War have been heavy adopters of first-person view (FPV) drones, an improvised form of LM. Thanks to their relatively simple construction, both sides have been able to produce these in large volume, with production now in the low millions of units per year for both Russia and Ukraine.

Surging demand in NATO

Even before the Russian invasion of Ukraine, Western nations recognized LMs’ potential. Government documents confirm that US Special Operations Command (SOCOM) acquired 1,000 Switchblade 300 units between 2012 and 2020, conducting up to 400 launches in Afghanistan during that timeframe; thousands of additional Switchblades were deployed by conventional forces.

Current US Marine Corps acquisition efforts include the Organic Precision Fires – Mounted (OPF-M) programme to equip light armoured reconnaissance and amphibious units with Hero-120 LMs, and the Organic Precision Fires-Light (OPF-L) programme to provide man-portable LMs to every infantry squad, with fielding to begin in 2027. In August 2024, the US Army awarded AeroVironment a five-year indefinite-delivery, indefinite-quantity (IDIQ) USD 990 million contract for Switchblade 300 and 600 LMs. A portion of this procurement will serve the goal, confirmed by Army Vice Chief of Staff Gen. James Mingus in June 2024, of acquiring more than 1,000 Switchblades to support the Replicator Initiative. Another portion will support the Army’s Low Altitude Stalking and Strike Ordnance (LASSO) project to provide Infantry Brigade Combat Teams (IBCTs) an organic BLOS precision-strike capability. The Switchblade 600 was selected as the Phase 1 effector. Procurement began in Fiscal Year 2025 with 434 All-Up Rounds (AURs), followed by a request for 294 AURs in the FY 2026 budget request. The immediate goal is to equip five IBCTs. The Army is pursuing additional capabilities to form a multi-tiered LM family-of-systems including medium- and long-range helicopter-launched effectors.

European nations are also intensifying efforts at the national and multinational level, most notably France and Germany. France is pursuing multiple initiatives to acquire domestically produced LMs. In March 2024, Defence Minister Sébastien Lecornu announced that France planned to purchase 2,000 LMs of various classes. Among such efforts was France’s Colibri programme for a UAV with a minimum 5 km range and 30 minute endurance, which culminated with the selection of the Delair/KNDS team’s MV-25 OSKAR, a fixed-wing LM with a 25 km range and 45 minute endurance. Thus far the DGA is known to have contracted a batch of 100 MV-25 OSKAR LMs for Ukraine.

France’s efforts on rotary-wing LM procurement have moved forward somewhat further. In July 2024, the DGA awarded Delair/KNDS team the development contract for the Munition Téléopérée – Courte Portée (ENG: Loitering Munition – Short Range), selecting the firm’s MX-10 Damocles quadcopter LM design. The team managed to develop, produce and qualify the LM within a single year. The DGA’s procurement contract calls for 460 units to be delivered in 2025, of which the first batch of 30 were slated to have been delivered in July 2025.

In April 2025, the German armed forces (Bundeswehr) announced procurement of “a large number” of LMs to be directly assigned to frontline units for in-depth operational evaluation. Contracts were awarded to the German start-ups Helsing SE (HX-2 ‘Karma’) and Stark Defence GmbH (OWE-V ‘Virtus’). Following evaluation in operational units, leadership will decide to either procure larger orders of the same LMs or consider acquiring alternative systems in support of the Force 2030 modernisation programme. The German MoD has not released a precise stockpile target, however, Simon Brünjes, Helsing’s vice-president of sales estimated a requirement for 120,000 to ensure sufficiency for 60 days of fighting while production ramped up, or increasing to 200,000 to ensure that 120,000 could be available in case of ammunition depots being targeted.

Industry’s response

Given their extant physical infrastructure, financing and staffing, established defence companies can be expected to have an innate advantage regarding the emerging market, especially since some have already established a track record for developing and fielding LMs. The challenge will be upgrading the ability to produce en masse and for short-term, crisis-driven demand cycles.

A prime example of proven manufacturers would be Virginia-based AeroVironment (AV). Founded in 1971, AV became an early pioneer of military unmanned aircraft development; operational introduction of the rucksack-compatible Switchblade 300 in 2012 helped make the firm a major player in the LM sector. The Switchblade 300 and 600 munitions can be launched by infantry or integrated on vehicles and special operations watercraft; they have also been test-launched from helicopters. Switchblade systems are still mostly operated by US and Ukrainian forces, but international interest is growing. To meet future demand, AV is making significant investments to expand production capacity, with perhaps the most notable example being the firm’s new 19,000 m2 FreedomWerx facility in Salt Lake City, Utah, expected to begin operations in the second half of 2025.

In October 2021, Rheinmetall and Israeli firm UVision Air Ltd. announced a strategic partnership to meet sharply increased demand for remotely controlled precision munitions. Under this framework, Rheinmetall has agreed to manufacture and supply UVision’s Hero LM family for the European market; the German firm is also responsible for certification of the Hero series to NATO standards. Production is being undertaken by Rheinmetall’s Italian subsidiary RWM Italia. In the course of this partnership Rheinmetall has also integrated the LM with various manned and unmanned vehicles. In September 2022, the Rheinmetall/UVision partnership secured its first sale of the Hero-30 to the Italian special forces, followed in July 2023 by a ‘low three-digit million-Euro range’ sale to Hungary and, in September 2023, the first sale of the Hero-120 in Europe (to an undisclosed customer).

Poland’s largest private defence manufacturer, WB Group, produces the Warmate family of LMs which can be equipped with various warheads depending on the mission. The flexible, swarm-capable system can be deployed by infantry or vehicles. On 15 May 2025, Poland’s armament agency signed a framework agreement with the WB Group for delivery of 10,000 Warmate LMs. This is the third, and by far the largest, order placed by the Polish MoD for this weapon system since 2017. In the accompanying press release, the firm described this as the largest single signed order for LMs in the world. The contract is slated for completion in 2035. The firm is also actively marketing the Warmate for export, most recently participating in the DSEI Japan in May 2025. Foreign customers include NATO members as well as Middle Eastern and Asian nations, with South Korea placing an order for “several hundred” Warmate munitions in October 2024, according to WB Group.

While established firms enjoy innate advantages, comparatively new technologies such as LMs also provide opportunities to dynamic young firms; not ‘burdened’ by established procedures and infrastructure, start-ups can immediately forge ahead with new production concepts that, if successful, could hypothetically transform the industry. If, that is, they can overcome such challenges as economies of scale, quickly establish an adequate physical manufacturing base, and secure reliable supply chains.

The German start-up Helsing, founded in March 2021, has lost no time establishing a market niche characterised by fast-paced weapon system development and maximum use of software-guided production processes. The firm’s public statements present a vision of scalable mass production at speeds much faster than currently demonstrated by major firms. Following multiple large orders from the German government, along with 4,000 HF-1s and 6,000 HX-2 LMs for Ukraine, Helsing now describes itself as “one of the largest manufacturers of strike drones globally”.

To finance its ambitious expansion plans, Helsing has raised USD 1.37 billion in investment capital in four major funding rounds between 2021 and 2025. The firm plans to establish several ‘resilience factories’ (RF) at different locations throughout Europe. This concept calls for decentralised mass production to ensure continuity if facilities in one allied nation are destroyed. Each RF will maintain its own localised supply chain. Helsing’s production concept emphasises an artificial intelligence (AI)-supported, software-centric approach that automates and accelerates complex processes. Efficiency is enhanced by contracting with other manufacturers to produce subassemblies and components according to Helsing’s specifications. The first resilience factory, RF-1, was completed in December 2024 at an undisclosed location in southern Germany. Helsing cites RF-1 as having an “initial monthly production capacity of more than 1000 HX-2s”. RF-2 is currently at the planning stage, and will have a higher production capacity. The firm expects its various RFs to jointly produce tens of thousands of units monthly during a crisis. However, to date Helsing has not published a timeline regarding construction of additional RFs.

Surge capability required

Just as governments and industry have recognised the need to significantly boost artillery production, they are also systematically pursuing expansion of LM manufacturing capacity. While adequate standing arsenals must be maintained to permit rapid response to crises, a major requirement will be the ability to rapidly scale up production on demand. General Pierre Schill, Chief of Staff of the French Army, summarised the problem during an October 2024 hearing before the French National Assembly. “The challenge for me is to have industries capable of producing the most up-to-date (LMs) possible, to have a production flow that allows training and a minimum stock, but above all to produce much more when I need it. The risk of building up stockpiles of such ammunition would be like having obsolete ammunition, so rapid is the evolution in this field.” Established firms and start-ups alike are racing to develop this capability.

Sidney E. Dean